The global economy is a complex and interconnected web that, despite its strengths, remains vulnerable to various shocks and disruptions. As we navigate through the 21st century, there are growing concerns that the world may be on the brink of a significant economic collapse. This looming threat is not the result of a single factor but rather a combination of various elements, including rising global debt, political instability, and systemic financial weaknesses. In this article, we will explore the indicators of an impending economic recession, the role of global debt, the impact of political instability, and practical steps you can take to safeguard your finances in the face of this economic crisis.

Understanding the Global Indicators of Economic Recession

Economic indicators serve as crucial barometers of the financial health of nations and the global economy. By examining these indicators, we can gain insights into potential economic recessions and prepare accordingly.

1-GDP Growth Rates:

One of the most telling signs of an impending economic collapse is the fluctuation in gross domestic product (GDP) growth rates. When GDP growth slows or contracts over consecutive quarters, it signals that an economy is in trouble. For example, during the 2008 financial crisis, many countries experienced severe GDP contractions, leading to widespread economic turmoil.

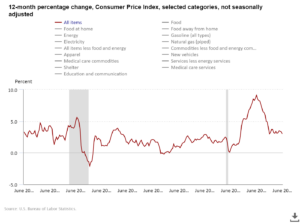

2- Inflation Rates

Inflation and deflation are also key indicators. While moderate inflation is typical in a healthy economy, hyperinflation or significant deflation can be warning signs of underlying economic issues. Hyperinflation erodes purchasing power and savings, while deflation can lead to decreased consumer spending and investment, both of which can trigger economic crises.

3- Stock market performance:

stock market performance is often viewed as a leading indicator of economic health. While the stock market is not the economy, significant declines or prolonged bear markets can reflect underlying economic problems. The dot-com bubble burst in 2000 and the subprime mortgage crisis in 2008 are prime examples where stock market crashes preceded broader economic collapses.

4- Political Instability:

Political instability is a significant factor that can precipitate an economic collapse. The relationship between political stability and economic performance is well-documented, with stable governments more likely to implement effective economic policies that foster growth and stability. Conversely, political instability can lead to economic uncertainty, reduced investment, and ultimately, economic crises.

By closely monitoring these indicators, we can better understand the warning signs of an economic recession and take proactive measures to mitigate its impact.

These Problems Were Present for a Long Time, So Why Should I Be Afraid Now?!

The issues leading to an economic collapse, such as rising global debt, political instability, and systemic financial weaknesses, have indeed been present for a long time. So, you might wonder why there is an increased sense of urgency now. Understanding why these problems have reached a critical point and why the current environment is particularly concerning is essential for grasping the gravity of the situation and taking appropriate action.

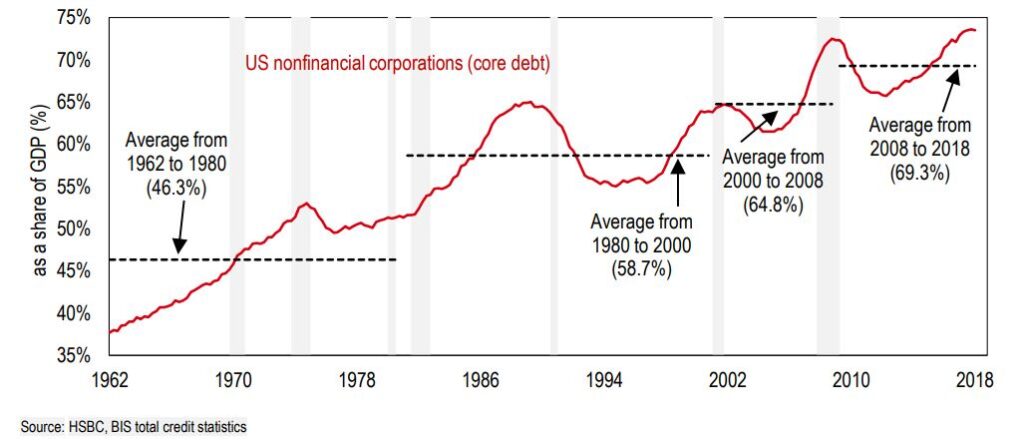

Accumulation of Debt

While global debt has been a growing concern for decades, its current levels are unprecedented. Both sovereign and corporate debts have ballooned to levels that are unsustainable. Countries and corporations have continued to borrow at historically low-interest rates, creating a massive debt bubble. The problem with such excessive borrowing is that it becomes increasingly difficult to service these debts as interest rates rise or economic growth slows.

Geopolitical Tensions and Trade Wars

Geopolitical tensions have always existed, but the current geopolitical landscape is more fragmented and volatile than ever. Trade wars, such as those between the United States and China, have strained international relations and disrupted global supply chains. Sanctions and retaliatory tariffs have increased the cost of goods and created uncertainty in the market.

Political instability within key economies also adds to the uncertainty. Brexit, for example, has caused significant economic disruption in the UK and the EU. Political upheavals in countries like Venezuela, Turkey, and various parts of the Middle East have further strained the global economy. The interconnected nature of today’s global markets means that political instability in one region can have far-reaching consequences.

Technological Disruption

The pace of technological change has accelerated dramatically, leading to significant disruptions in the job market and various industries. Automation, artificial intelligence, and digital transformation are reshaping economies, sometimes faster than they can adapt. While these technological advancements offer numerous benefits, they also create new challenges, such as job displacement and increased inequality

Conclusion

The problems leading to an economic collapse have been building for a long time, but the current environment is particularly precarious. The convergence of high debt levels, geopolitical instability, technological disruption, and social factors creates a fragile economic landscape. It’s essential to recognize these risks and take proactive steps to safeguard your finances.